Lessons From Companies That Missed the Technological Inflection Point

History has shown that companies that fail to adapt to technological disruptions and market transformations can struggle to remain relevant, and even disappear altogether. Ignoring consumer trends, resisting change, or even failing to invest in emerging technologies often lead their products and services to become obsolete.

At vpnMentor (VM), we analyzed the decline of companies across a variety of sectors, focusing on their failure to adapt to technological transformations or market shifts that led to significant restructuring or closure.

This research centers on Intel, which, like former industry leaders Kodak and Nokia, has faced challenges from missed opportunities and an inability to capitalize on emerging technological trends. By examining these cases, we aimed to uncover patterns of missed opportunities and highlight lessons for businesses on the importance of adapting to technological change.

Intel’s Struggles: A Brief Study

Intel, once a leader in the semiconductor industry, has faced significant challenges in recent years. Despite its dominance in the CPU market, the company struggled to adapt to key technology shifts.

Since the mobile revolution, sparked by the iPhone in 2007, Intel has missed several critical inflection points, including:

- Delays in adopting smaller nanometer processes

- Failing to enter the mobile processor market, which allowed competitors like AMD, Nvidia, and TSMC to outpace Intel in chip innovation

- Underestimating the importance of AI-driven Graphical Processing Units (GPUs)

Additionally, supply chain disruptions, leadership missteps, and reliance on legacy architecture contributed to Intel’s decline in critical segments like data centers, AI chips, and consumer CPUs.

Overview of Analyzed Companies

This study examines 66 companies and products that failed to adapt to technological shifts, leading to missed opportunities and, in some cases, their decline or transformation. The companies represent a sample of regions and industries that offer valuable insights into the factors behind these failures.

Table of Analyzed Companies

| Company Name | Region | Industry | Status |

| Abercrombie & Fitch | United States | Retail | Rebranded its products |

| AOL | United States | Technology | Merged into Verizon |

| Atari | United States | Video Games & Toys | Bankrupt |

| Barnes & Noble | United States | Retail | Introduced digital offerings |

| Blockbuster | United States | Retail | Bankrupt |

| Borders | United States | Retail | Bankrupt |

| British Home Stores | Europe | Retail | Ceased operations |

| Circuit City | United States | Retail | Bankrupt |

| Clinton Cards | Europe | Retail | Restructured |

| Commodore Corp | United States | Technology | Ceased operations |

| Compaq | United States | Technology | Acquired |

| Coty | Europe | Retail | Restructured product lines |

| DeLorean Motor | United States | Automotive | Ceased operations |

| Enron | United States | Energy & Industry | Bankrupt |

| Ford | United States | Automotive | Focuses on energy efficient vehicles, including EVs |

| Fab.com | United States | Retail | Ceased operations |

| General Electric | United States | Energy & industry | Shifted focus back to core industries |

| Google: Google+, Google Glass, Google Nexus Q | United States | Technology | Discontinued |

| Hitachi | Japan | Technology | Focused on energy and infrastructure |

| HMV | Europe | Retail | Bankrupt |

| Hostess | United States | Food & beverage | Restructured and rebranded |

| Hummer | United States | Automotive | Rebranded |

| IBM | United States | Technology | Shifted to cloud & AI |

| Intel | United States | Technology | Adopted data & AI |

| JCPenny | United States | Retail | Restructured |

| J. Crew | United States | Retail | Bankrupt |

| Kodak | United States | Technology | Shifted to digital imaging |

| Macy's | United States | Retail | Shifted product line |

| Mattel | United States | Video Games & Toys | Refocused on digital and educational toys |

| Mattress Firm | United States | Retail | Bankrupt |

| MapQuest | United States | Technology | Adjusted strategy with product upgradation |

| Motorola | United States | Telecommunications | Acquired |

| Microsoft | United States | Technology | Discontinued certain products |

| MTV | United States | Media & Entertainment | Shifted to reality TV |

| MySpace | United States | Technology | Declined |

| National Geographic TV | United States | Media & Entertainment | Shifted to streaming |

| Netscape | United States | Technology | Ceased operations |

| Nike: Nike FuelBand | United States | Wearable technology | Discontinued |

| Nokia | Europe | Technology | Focused on networking technology |

| Nortel | Canada | Telecommunications | Bankrupt |

| Pan American World Airways | United States | Aviation | Ceased operations |

| Palm | United States | Technology | Acquired |

| Pebble | United States | Wearable Technology | Acquired |

| Pets.com | United States | Technology | Bankrupt |

| Polaroid | United States | Consumer Electronics | Shifted to instant printing products |

| Procter & Gamble (P&G) | United States | Retail | Shifted product focus |

| RadioShack | United States | Retail | Bankrupt |

| Research in Motion (BlackBerry) | Canada | Technology | Moved to software and cybersecurity |

| Sega | Japan | Video Games & Toys | Discontinued hardware products |

| Sears | United States | Retail | Bankrupt |

| Segway | United States | Automotive | Ceased operations |

| Sony Walkman | Japan | Technology | Discontinued |

| Steam Console | United States | Video Games & Toys | Discontinued |

| Target | United States | Retail | Changed product strategy |

| The Daily | United States | Media & Entertainment | Discontinued |

| Toshiba | Japan | Technology | Shifted focus to infrastructure, semiconductors and devices |

| Tower Records | United States | Retail | Bankrupt |

| The Concorde | Europe | Aviation | Ceased operations |

| The Sharper Image | United States | Retail | Bankrupt |

| Tie Rack | Europe | Retail | Ceased operations |

| TiVO | United States | Technology | Acquired |

| Vine | United States | Technology | Closed |

| WeWork | United States | Commercial Real Estate | Restructured |

| Xerox | United States | Technology | Adjusted strategy |

| XFL | United States | Media and Entertainment | Relaunched |

| Yahoo | United States | Technology | Acquired |

The table above provides a snapshot of the companies discussed in the analysis. In the subsequent sections, we’ll examine the data to uncover patterns based on geography, industry, and missed opportunities.

Cases of Missed Technological Shifts

History has shown that failing to adapt to technological turning points and shifting consumer needs has been a critical challenge for companies globally, often leading to their downfall.

Geographical Patterns of Technological Failures

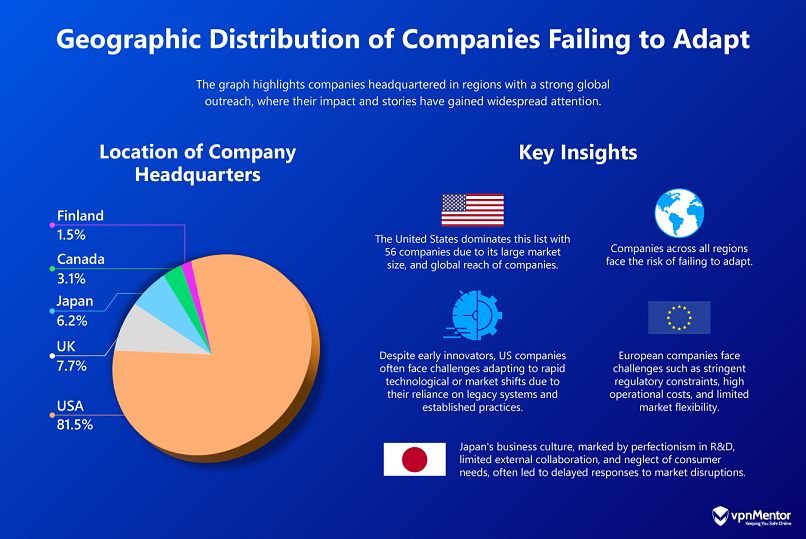

This section examines whether businesses from specific geographical regions, such as the United States, Europe, or Asia, impact a company's ability to navigate market disruptions successfully. Analyzing data from 65 companies and products that failed to adapt, we examine regional patterns alongside any cultural, regulatory, and market factors contributing to these outcomes.

Note: While the geographical distribution in this study highlights certain trends, it also underscores the limitations caused by insufficient data from under- or un-represented regions, particularly with companies that failed to adapt at the time. Expanding the graph to include these areas would require additional resources.

The findings reveal that 81.5% of the companies studied were headquartered in the United States. These companies and products, once pioneers, were often constrained by reliance on legacy models, as seen with Kodak and Polaroid. 6.2% of the companies were Japanese which, particularly in the cases of Sony’s Walkman and Sega’s consoles (hardware), struggled due to delayed adaptation to emerging technologies and poorly timed product launches.

European companies like Nokia faced challenges from overregulation and an inability to analyze and adjust strategies to shifting market demands. Similarly, Canadian companies like BlackBerry lost their position due to failure to prioritize user experience, and underestimating the competition from iOS and Android platforms.

The trend highlights how these companies, once leaders in their industries or product categories, faltered due to common challenges like relying on legacy systems and hardware, misjudgment of market changes, and failure to embrace new technologies. However, we shouldn’t forget the role played by geopolitical constraints, as demonstrated in the case of Pan American World Airways (Pan Am).

Once a symbol of luxury and a pioneer in commercial air travel, Pan Am collapsed due to a complex interplay of financial crises, geopolitical instability, and industry disruptions. Established in 1927, Pan Am was known for connecting continents with routes spanning Europe and Asia.

Its downfall began with the 1973 and 1979 OPEC oil crises, which caused fuel prices to rise and disrupted long-haul travel markets, including reduced passenger demand. This started the airline’s financial troubles. The deregulation of the US airline industry in 1978 added to Pan Am’s challenges. While it increased price competition, Pan Am lacked a domestic network, leaving it struggling against competitors like Delta and American Airlines, which expanded into both domestic and international markets.

The final blow were the acts of terrorism against its flights. The hijackings of Pan Am Pan Am flights number 73, 281, and 841, as well as the Lockerbie bombing, inflicted significant financial losses and damaged its brand. Despite efforts to restructure and sell assets, Pan Am ceased operations in 1991.

This case study highlights that while technological innovation is important, companies must also be resilient to external factors like geopolitical changes that can create challenges beyond their control.

Sectoral Patterns of Technological Failures

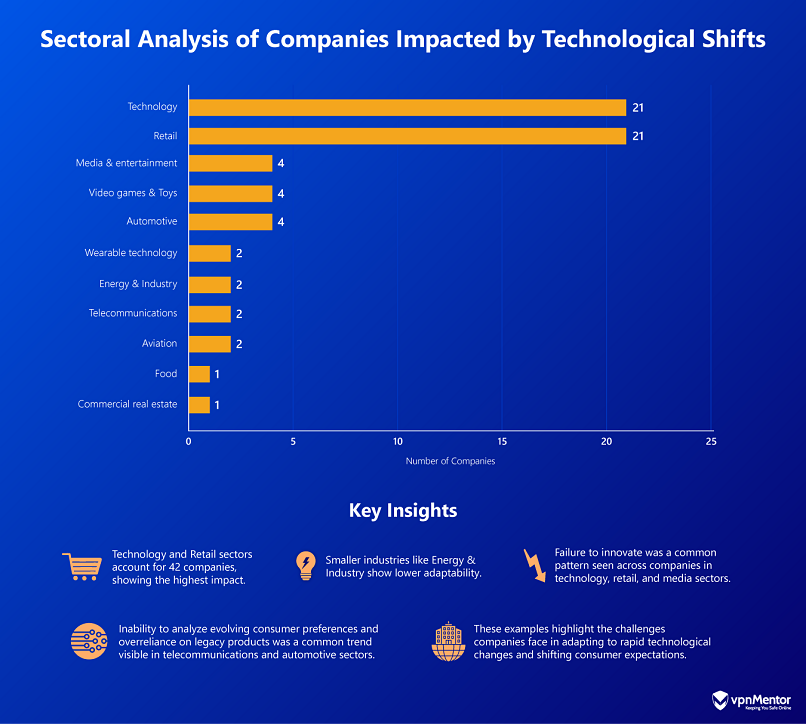

In this section, we further examine the common patterns across industries to determine whether the adaptability of the companies discussed is influenced by their respective sectors.

In the above graph, the companies have been grouped into 11 industrial categories, with the technology and retail sectors leading with 21 companies each. These are followed by the Media & Entertainment, Video Games & Toys, and Automotive sectors. Sectors like Wearable Technology and Energy & Industry also feature notable examples, with fewer companies experiencing setbacks.

The dominance of technology and retail companies highlights their reliance on consumer preferences and innovation cycles. Atari, a pioneer in video gaming, shows how market saturation, poor product decisions, and fierce competition can erode industry leadership.

Founded in 1972, Atari revolutionized the video game industry with its Atari 2600 console, setting standards for hardware (especially consoles) and gameplay while popularizing home gaming. However, the "video game crash of 1983" led to a rapid decline, with Atari losing $500 million. The success of Atari inspired several copycat companies that flooded the market with consoles and low-quality games. This oversaturation frustrated consumers and damaged the industry’s reputation.

A critical misstep was the rushed release of the poorly designed E.T. game, which flopped and left Atari with millions of unsold cartridges. Leadership changes failed to resolve the company’s issues, while competition and legal battles with Nintendo, along with the commercial failure of the Atari Jaguar console, forced Atari to exit the console market, marking the fall of a once dominant player in the video games industry.

Similarly, in retail, giants like Sears and HMV were unable to adapt to the growth of e-commerce and shifting consumer purchasing habits.

This sector-focused analysis provides valuable insights into how companies in these industries are impacted by fast-changing market dynamics. Their inability to innovate and align with emerging trends can often bring down even established companies.

Lost Opportunities: How Industry Leaders Fell Behind

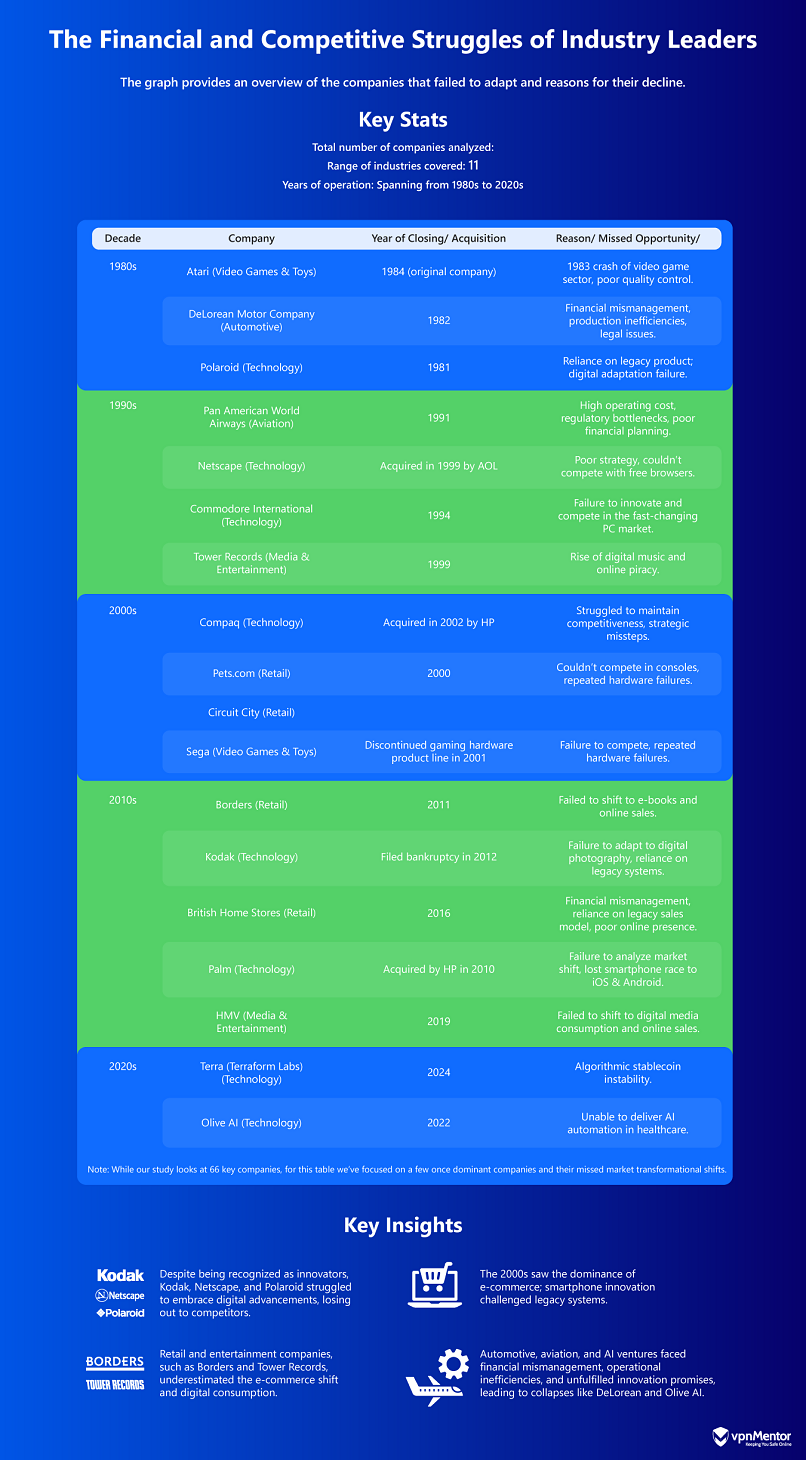

Technological transformations have reshaped industries, often leading to decline or even collapse of once dominant companies that failed to capitalize on the emerging trends, sometimes combined with mismanagement and market misreading.

This section explores how these companies missed opportunities, supported by financial metrics that highlights their downfall compared to competitors who embraced innovation and succeeded.

Note: While our study looks at 66 key companies, for this table we’ve focused on a few once dominant companies and their missed market transformational shifts.

Over the decades, once-dominant companies have fallen victim to recurring themes of failure, like overexpansion without sustainable models, misrepresented technological capabilities, and reliance on outdated systems.

The inability to recognize technological and market shifts caused companies like BlackBerry, Nokia, Vine, and Sears to lose their market dominance.

Once a dominant force in the mobile device market, BlackBerry’s fall was one of the most dramatic in the tech industry. Known for its BlackBerry Messenger (BBM), which revolutionized instant messaging, the company’s decline was not sudden but the result of errors in strategy and vision.

BlackBerry failed to anticipate that everyday consumers, not just business users, would drive the smartphone revolution. Its overreliance on business customers, loyalty to its operating system, and inability to embrace the emerging “app economy” allowed competitors like Google and Apple to surpass it. The company also underestimated the transformation of smartphones into comprehensive mobile entertainment units.

BlackBerry’s insistence on producing phones with full keyboards, despite the growing preference for touchscreens, proved to be a critical misstep. Competitors prioritized convenience and accessibility, creating devices that appealed to both everyday and business users. In an attempt to reclaim its market dominance, BlackBerry launched a touchscreen device, but it was regarded as an imitation of the iPhone, further accelerating its decline.

Following its acquisition by Fairfax Financial, BlackBerry shifted its focus to cybersecurity and software services in an effort to reinvent itself. While this shift showed its ability to adapt, the company’s failure to maintain its leadership in the smartphone market is a lesson for other technology firms.

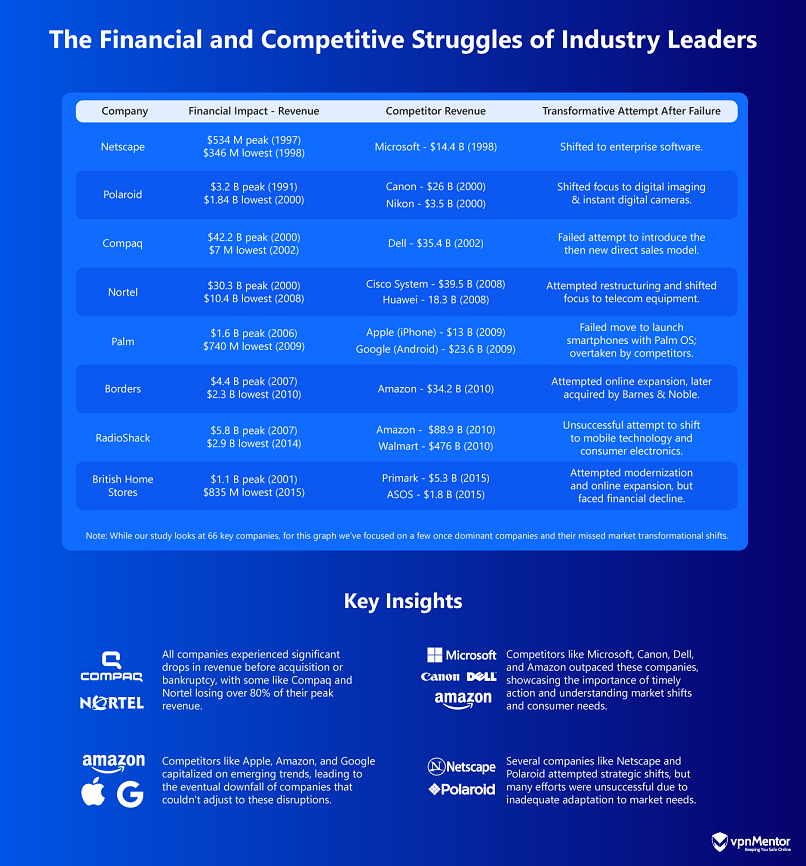

Note: While our study looks at 66 key companies, for this graph we’ve focused on a few once dominant companies and their missed market transformational shifts.

Several major companies, including Netscape, Borders, and Compaq, saw their revenues significantly decline as they struggled to adapt to changing market conditions.

Once a giant in the book-selling industry, Borders’ decline to bankruptcy contrasts sharply with its rival, Barnes & Noble (B&N), which adapted to changing market dynamics.

In the 1990s, as Amazon emerged as an online book retailer, Borders failed to embrace the digital age. While B&N launched its internet store, Borders focused on expanding brick-and-mortar stores both domestically and internationally. It also outsourced online sales to Amazon, losing customers to a rival.

Moreover, Borders overlooked the rise of e-books and digital readers. Amazon launched Kindle in 2007, and B&N followed with Nook in 2008, but Borders entered the e-book market late in 2010 through a partnership with Kobo Inc., amid its financial struggles.

Additionally, Borders heavily invested in CD and DVD technologies, even as digital music and piracy reshaped the industry, deepening the retailer’s financial worries. The 2008-09 recession further burdened the debt-laden company, leading to its bankruptcy in 2011 and eventual acquisition by Barnes & Noble in 2012.

The fall of Borders underscores the necessity of adapting to technological and market shifts to sustain business success.

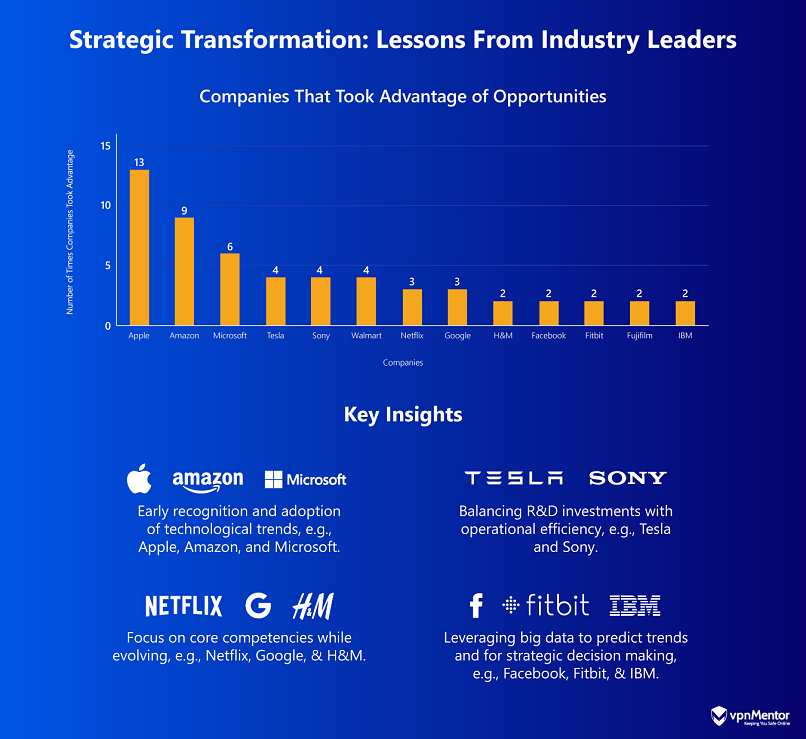

Similarly, many of the discussed 66 companies — such as Kodak, Polaroid, Sega, and Hummer — attempted transformative shifts, but were often outpaced by competitors like Microsoft, Amazon, Tesla, Sony, and Apple, which better capitalized on emerging technological trends.

These failures demonstrate the vital importance of innovation and the ability to adapt to new market demands.

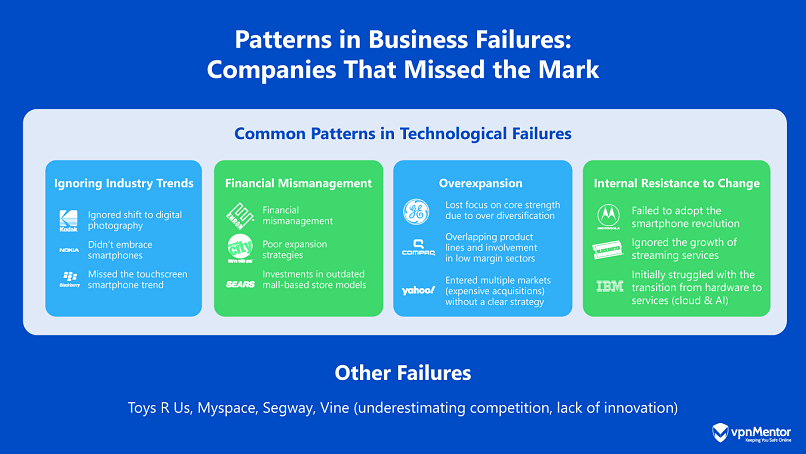

Common Patterns in Technological Failures

The downfall of leading companies often follows common patterns, including ignoring industry trends, mismanaging finances, underestimating competitors, overexpansion, and resistance to change. Understanding these failures provides valuable insights for businesses trying to thrive in today’s evolving market.

Once dominant and pioneering companies like MapQuest and Polaroid lost relevance by ignoring industry trends, while competing companies adopted emerging technologies.

Established in 1937, Polaroid became synonymous with instant photography, renowned for its innovative instant cameras. Despite being a market leader in digital cameras in the late 1990s, the company struggled to adapt to the digital revolution.

Polaroid overinvested in research and development but delayed product launches in pursuit of perfection, allowing competitors like Sony and Canon to outpace it with faster innovations. Simultaneously, management’s insistence on maintaining outdated technologies and substantial investment in the instant film business limited both product diversification and market relevance.

While consumer preference shifted toward convenience and digital sharing, driven by the demand for digital photography and smartphones, Polaroid remained fixated on its legacy products. This resistance to change, combined with delayed market entry for new products, eroded its market share.

By 2001, declining sales and strategic missteps led Polaroid to file for bankruptcy. Its story remains a lesson that an obsession with perfection and a failure to adapt to evolving technologies can bring down even the most iconic brands.

Similarly, financial mismanagement, as seen with RadioShack and Enron, can drain a company’s resources through miscalculations in investments. Some companies, rather than waiting for perfection like Polaroid, launch products before the technology is fully realized and the public ready to adopt their use — for example, Google Glass.

Others resisted change. Blockbuster for example missed the rise of streaming services and the chance to acquire Netflix, leading to its decline. These cases highlight the importance of agility and foresight in today’s competitive market.

Lessons from Failure: What Can Businesses Learn?

The failures of once-successful companies offer important lessons for businesses today. By understanding missteps such as ignoring trends, poor strategies, or overreliance on legacy systems and products, companies can avoid repeating mistakes and stay competitive in a fast changing world.

As noted earlier, companies like Kodak, Nokia, and Blockbuster struggled due to their slow recognition and response to technological changes, resulting in missed opportunities for innovation. In contrast, companies like Amazon and Netflix thrived by adopting disruptive technologies early, positioning themselves as leaders by continuously adapting to market trends and customer needs. Their continuous investment in customer-centric innovation has allowed them to dominate their respective markets.

Balancing innovation with operational efficiency is another key lesson. Companies like Ford and Sears faltered because they failed to combine bold innovations with efficient execution. On the other hand, firms like Tesla and Apple succeeded by investing strategically in both cutting-edge technologies and scalable solutions, ensuring long-term growth and competitive advantage.

Another key factor is keeping pace with customer expectations and industry trends. Companies like JCPenney and HMV failed to adapt to the rise of e-commerce, leading to their decline. Meanwhile, companies like Apple and Shopify adopted new consumer behaviors and technology, continually enhancing their offerings and customer experiences, thereby succeeding in competitive markets.

Ultimately, the ability to recognize and respond to technological trends early can be the key to success or failure. By learning from past mistakes, businesses must prioritize agility, embrace innovation, and lead through change to avoid missing market inflection points.

Methodology

This research relied on manual data collection, beginning with the identification of 125 companies across various sectors, including retail, technology, and consumer electronics. After reviewing reputable sources, the study focused on 66 companies and products that were once industry leaders but failed to recognize and respond to emerging trends.

To organize the data, a structured spreadsheet was created to capture essential details such as company name, sector, headquarters, founding and closure dates, missed opportunities, and competitors that seized those opportunities. This enabled a thorough examination of how these companies failed to adapt to technology shifts and trends.

The analysis also involved reviewing financial and market performance over select years to understand how competitors gained market share and contributed to the decline of these companies. Visualizations and graphs were created to highlight common patterns and trends that these companies encountered. The final report provides valuable insights by highlighting the lessons learned from these failures and the importance of adapting to technological and market changes.

Discussion

In conclusion, the analysis of companies that failed to adapt to technological shifts provides valuable lessons for businesses today. The inability to recognize and respond to emerging trends often leads to missed opportunities and decline. On the other hand, businesses that embrace innovation early and stay ahead of market changes can emerge as leaders.

The common patterns of failure, such as reliance on outdated systems, poor market predictions, and resistance to change, showcase the importance of agility, balancing innovation with operational efficiency, and keeping pace with evolving customer expectations. By learning from past mistakes, businesses can navigate the rapidly changing markets and avoid falling behind their competitors.

Please, comment on how to improve this article. Your feedback matters!